The United States, and particularly the US food industry, is facing an extraordinary challenge from the Coronavirus pandemic. The virus is having an impact like a major natural disaster. Supply chains have become strained overnight and need to be reorganized to fit the new dynamically changing environment.

Two weeks ago, Americans were not rushing to the store to buy frozen food, bottled water, cleaning products, toilet paper etc., but now we’ve all seen packed checkout lines and barren grocery store shelves. Restaurant closures coupled with a lack of inventory and the chaotic atmosphere at grocery stores has forced a lot of people online to shop for food – many that have resisted online food shopping.

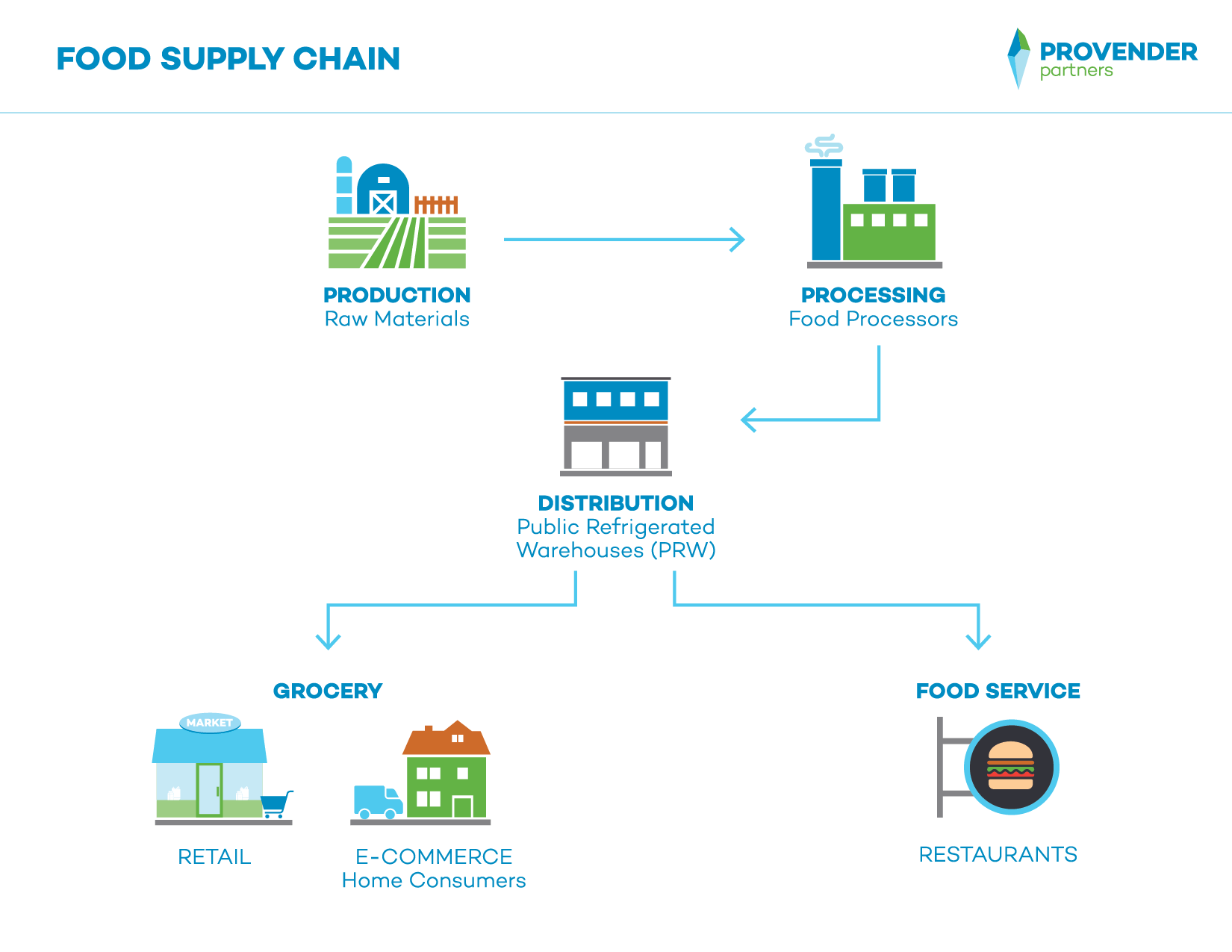

Most people don’t realize that the US food supply chain is not just one large monolith, but it can be separated into four distinct categories: Processors, Public Refrigerated Warehouse (PRWs), Grocery & Food Service.

- Processors purchase raw materials such as grains, milk, or pork, and produce items such as bread, cheese, or sausages, which then end up in grocery stores and restaurants.

- PRWs serve as the logistics support for Processors, Food Service and Grocery industries, storing and / or delivering all types of raw and processed foods.

- Grocery category contains your typical grocery stores, meal kits (Blue Apron) and home delivery (online food shopping), i.e. Amazon Fresh.

- Food Service includes restaurants, hospitals, schools, and hotels.

Two of the four supply chain categories get food into the hands of consumers: Food Service aka restaurants and Grocery stores or grocery home delivery. Aside from hoarding, one would assume that the same amount of food is being consumed. Unfortunately, the food destined for restaurants can not simply be re-routed to grocery stores. One reason for this is that Food Service bulk packaging is much different than Grocery stores. As a result, Food Service companies are tanking, Performance Food Group is down over 60%. Conversely, wholesale grocer UNFI is up over 75%. Most notably, the beleaguered meal kit company Blue Apron is up 550% over the last week!

Per Nielson data, while online grocery performance has increased 45% on average each of the past three years, that growth rate has been driven by core shoppers (10% of grocery shoppers accounted for 50% of growth). This has led to the assumption that online grocery shopping will be nearing a tipping point, and growth rates will start to fall. While the younger and middle-age population segments have been quick to adopt online trends, baby boomers and senior citizens have been slow to adopt online grocery shopping. The ease and convenience of online grocery shopping hasn’t seemed to outweigh the ability to physically see and feel the fresh meat and produce, until now.

The Coronavirus has shocked the food industry and the general line of thinking is that the people that have been forced online will return to retail stores in increasingly fewer numbers, changing the face of grocery, and grocery online shopping forever.