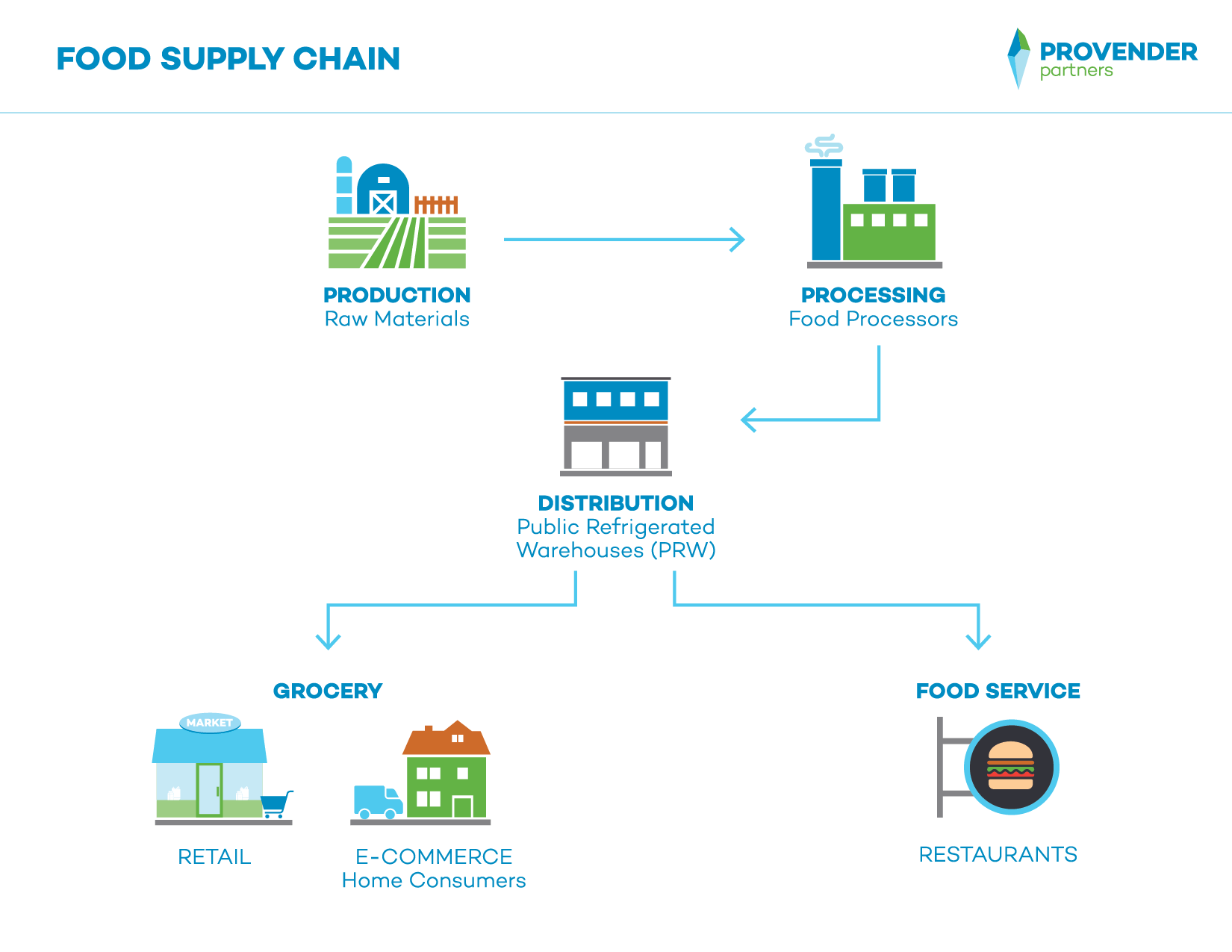

Every facet of the grocery supply chain is being shocked to its core and is facing unprecedented challenges. As a follow up to our recent discourse on the “The Food Supply Chain,” here we share our outlook on how the changing supply-chain landscape will affect inventory management strategy on a go-forward basis.

Just In Time Strategies Don’t Work During a Pandemic

Technological advances have greatly improved the supply chain, which have exponentially benefitted grocers who have more complex supply chains given their large number of SKU’s and perishable items. This has manifested itself in the larger grocers implementing Just in Time (“JIT”) inventory strategies. JIT means that the grocery chains hold limited inventories and transfer the burden of inventory and delivery of product from grocers to the food processors. As a result, processors have had to add storage space on-site and/or utilize Public Refrigerated Warehouses (“PRW’s) to warehouse products to be “at the ready” for the grocers.

The trend grew as grocers saw the benefits of JIT through decreased warehousing and labor cost and lower rates of spoilage. The reduced need for on-site inventory at the retail stores enabled grocers to fit in smaller retail footprints, which lowered their fixed costs, and improved margins.

Increased Need for Warehouse Space as Grocers Take Back Control of Their Inventories

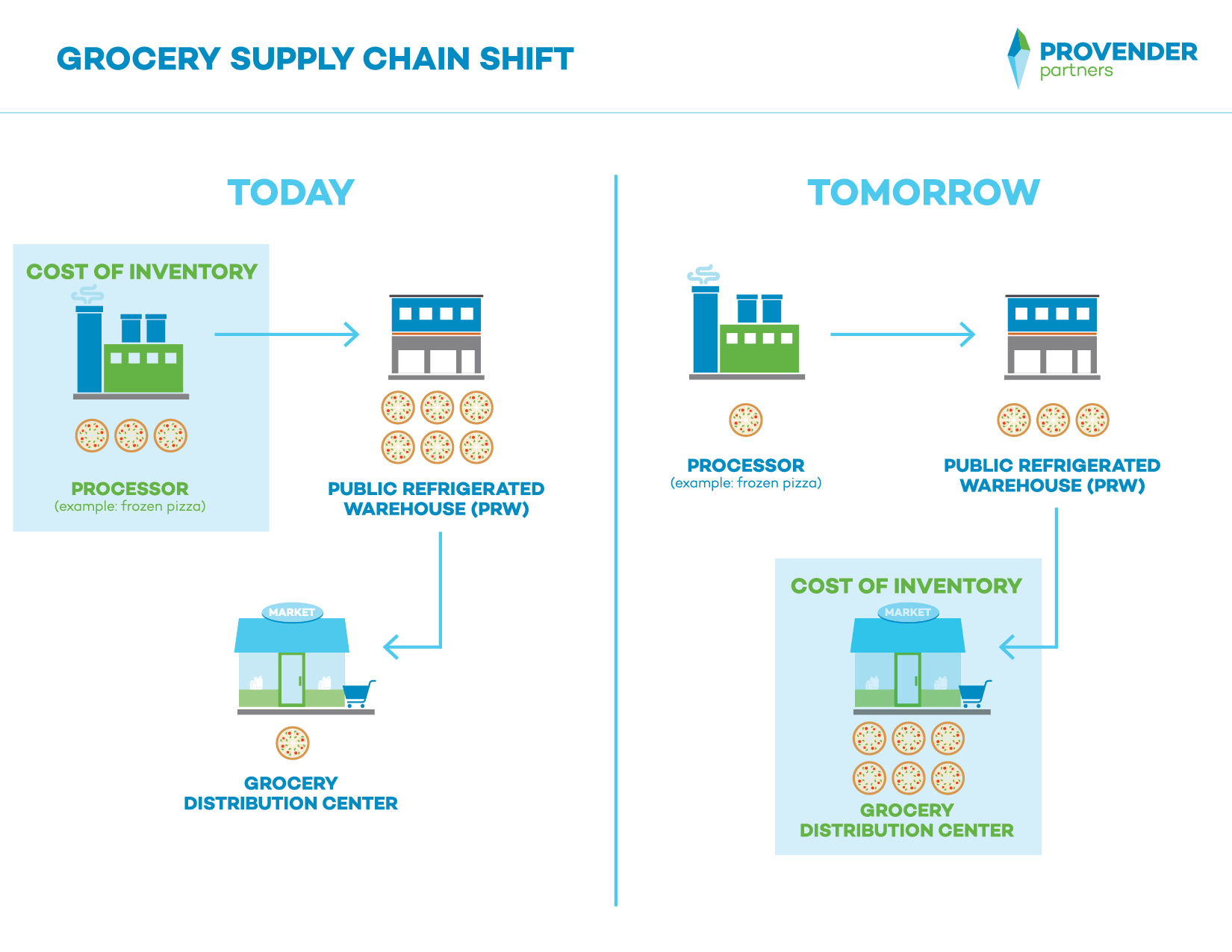

JIT has its drawbacks, which include forecasting risks and late deliveries, i.e. empty store shelves, both of which are occurring now and are wildly exacerbated by the Coronavirus epidemic. In an effort to combat future force majeure events, we expect to see grocers taking back control of their inventories. Presumably, this will lead to an increased need for warehouse space on the part of grocers, as grocers look to add perishable space to their distribution centers or secondary/contingent locations while maintaining the desire for smaller grocery stores. The infographic below demonstrates how this might change the grocery supply chain.

Grocers are playing catch up as food processors and providers of raw materials output are slowed by social distancing and other Coronavirus related impacts. Farmers and processors were already reacting to the pressures of JIT and pursuing initiatives that suited JIT inventory strategies such as vertical farming. Indoor growers have dramatically lowered crop cycles and have certainty of product availability which is of the utmost importance for JIT. Labor is another large part of the processor equation. With workers at food processors, delivery companies, and grocers being deemed “essential workers” in the fight against coronavirus, this status entitles them to higher wages and benefits – that genie may be hard to put back in the bottle once the pandemic is over.

A Return To Traditional Production & Warehousing Models: A Win for Regional Processors?

If what we believe comes true, grocers will come full circle in inventory strategies, as grocers take more control over their inventories and processors to move back to a more traditional model of production and warehousing. Consumers are warehousing more food in their homes, resulting in more food in the system as a whole. Grocers were already working with regional processors to have redundant facilities to ensure product delivery. This has become more of an issue as smaller more regionally focused processors have emerged taking market share from “Big Food”. Labor let alone skilled food labor was already difficult to obtain and looking to be much more expensive.

These factors will ripple through the grocery supply chain as it is restructured, and grocers look to expand existing or secure new facilities.